NIELSEN: MOST KOREANS THINK “KOREA IS IN AN ECONOMIC RECESSION”

MOST OF KOREAN CONSUMERS (79%) ARE PESSIMISTIC ABOUT THEIR PERSONAL FINANCES IN THE NEXT 12 MONTHS

SPENDING INTENTIONS AND JOB PROSPECTS ARE MORE HIGHLY NEGATIVE THAN THE AVERAGE OF THE GLOBE AND ASIA PACIFIC REGION

MAJOR CONCERNS ARE ‘JOB PROSPECTS’ (17 %)-‘WORK/LIFE BALANCE’ (16%)-

‘THE ECONOMY’ (15%)

-

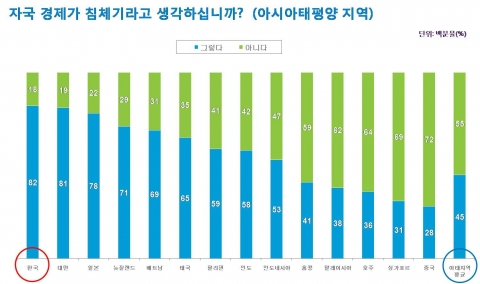

(Graph 1) Perception on the Local Economy

-

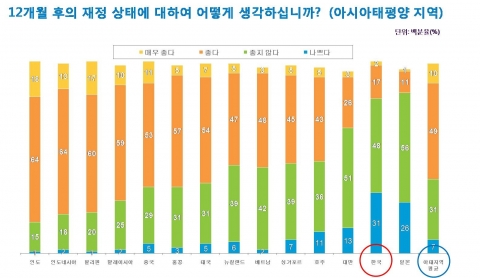

Perception on the Personal Finances over the next 12 months

SEOUL--(Korea Newswire)--More than 8 out of 10 Korean consumers(82 percent) think that Korea is in an economic recession, according to a new study from Nielsen, a leading global provider of information and insights into what consumers watch and buy. Nielsen’s study shows that more than half of these respondents (53 percent) say that Korea will not be out of recession in the next 12 months.

The Nielsen Global Survey of Consumer Confidence and Spending Intentions surveyed between May 4 and May 21 with more than 28,000 internet respondents in 56 countries shows that 6 out of 10 global consumers(57 percent) and 45 percent of Asia Pacific consumers say their economy is in a recession. It indicates that Korean consumers are the most pessimistic about local economy in the Asia Pacific region. (See graph 1)

MOST OF THE KOREAN CONSUMERS (79%) ARE NEGATIVE ABOUT THEIR PERSONAL FINANCES IN THE NEXT 12 MONTHS

It appeared that 8 out of 10 Korean consumers(79 percent) are negative about their personal finances in the next 12 months, which is the same level to the previous quarter(1Q 2012) and the same period in the previous year(Q2 2011), but much more higher than the global(44 percent) and Asia Pacific(38 percent) regional average.

SPENDING INTENTIONS AND JOB PROSPECTS ARE HIGHLY NEGATIVE

THAN THE AVERAGE OF THE GLOBE AND ASIA PACIFIC REGION

When asked perceptions of good/bad time to buy things they want and need at the moment, considering the cost of things today and their own personal finances, the majority of Korean consumers(86 percent) responded “Not so good”(38 percent) or “Bad”(48 percent), which is much higher than the global(65 percent) and Asia Pacific(62 percent) regional average.

Nielsen’s survey also shows that 9 out of 10 Korean respondents (87 percent) look pessimistic about local job prospects in the next 12 months, which is down one percentage point from the previous quarter but up four percentage points from the previous year. Koreans’ anxiety about job prospects is much higher than the average of global (49 percent) and Asia Pacific (37 percent) consumers.

MAJOR CONCERNS FOR KOREANS ARE ‘JOB PROSPECTS’(17%)-‘WORK/LIFE BALANCE’ (16%)-‘THE ECONOMY’ (15%)

GLOBAL AND ASIA PACIFIC CONSUMERS’ BIGGEST CONCERN IS ‘THE ECONOMY’

Job prospects(17 percent) is selected as the biggest concern for Koreans, followed by work/life balance(16 percent) and the economy(15 percent) while the economy(17%) was chosen as the biggest concern in the previous quarter. Meanwhile, global (16 percent) and Asia Pacific (16 percent) consumers selected the economy as the biggest concern in the next 6 months.

Q2 GLOBAL CONSUMER CONFIDENCE INDEX DECLINED SLIGHTLY …ASIA PACIFIC IS THE MOST OPTIMISTIC REGION FOR 4 CONSECUTIVE QUARTERS

KOREA RANKED 51ST AMONG TOTAL 56 MARKETS

Global Consumer Confidence (91 index), which is down three index points from the previous quarter, is on a downturn again. Confidence in Asia Pacific region (100 indexes) declined with three index points but maintain as the most optimistic region for four consecutive quarters.

Confidence declined in 26(41 percent) of 56 markets, increased in 23 and remained flat in seven markets.

While India had been the world’s most optimistic market for nine consecutive quarters according to Nielsen’s survey, Indonesia reported the highest consumer confidence index in Q2 at 120, topping India’s score of 119. Philippines (116 index), Saudi Arabia (115 index) and Malaysia (111 index) ranked together at the top level. Korea(50 index), which is up one index point from the previous quarter but down two index points from the previous year, ranked 51st among the total 56 markets.

The biggest quarterly consumer confidence gains in Q2 were reported in France (+11), Belgium (+9), Finland (+7) and Switzerland (+7) while the biggest quarterly consumer confidence declines in Q2 were reported in Taiwan (-12), Argentina (-5), Australia (-5), China (-5), Netherlands (-5), United States (-5).

“Consumers are clearly proceeding with caution in relation to their spending intentions,” said Dr. Venkatesh Bala, chief economist at The Cambridge Group, a part of Nielsen. “Consumer confidence lost momentum in the second quarter as global events, including a worsening Euro zone crisis coupled with slowing growth rates in China and India, impacted financial markets and consumer sentiment in many parts of the world. As renewed volatility entered global markets, consumers reacted by reining in spending and consumption intentions.”

Website: https://nielseniq.com

Contact

Corporate & Marketing Communications

Nielsen Korea

Hee Jung Yang, manager

+82-2-2122-7080

This is a news release distributed by Korea Newswire on behalf of this company.